Rethinking Innovation

The world changes fast, so does our understanding of innovation.

Tuesday, 22 April 2014

When technology spreads slowly

"One of the most important issues in thinking about the economic growth potential for the U.S. economy is this question: Has the U.S. economy already seen most of the economic growth that will result from the innovations in information and communication technology, including the web, the cloud, robotics, and so on? Or is the U.S. economy perhaps only a fraction of the way--perhaps even less than halfway--through its adaptation to the potential for productivity gains from these technologies, and thus has stronger prospects for future growth?"

Read the remaining here

Wednesday, 16 April 2014

All innovation is good, unless it is bad

Innovation has a very positive meaning, while when is comes to financial innovation the connotation nowadays is very negative. For the financial innovations this is not without a reason, since it seems that the financial innovations were not designed to create more value for the customer, but actually create perceived new added value that turned out to be high risk products against which the creators of the financial innovations were betting. Winning by betting against the products you were selling. Now the current hot topic in financial innovations are High-Frequency Trading. The maing question is what function do they serve to the financial markets and the economy in general. Obviously they HFT emerged because of the incentive of each trader to be faster than their competitor. But the main question is if this also has benefits to the market and the economy in general. Stiglitz enters the debate:

"The U.S. banking sector has become less efficient in recent decades despite the increased use of new technologies like high-frequency trading and products such as derivatives, according to two papers presented at a Federal Reserve Bank of Atlanta conference." Read the rest of the article here

"The U.S. banking sector has become less efficient in recent decades despite the increased use of new technologies like high-frequency trading and products such as derivatives, according to two papers presented at a Federal Reserve Bank of Atlanta conference." Read the rest of the article here

Wednesday, 9 April 2014

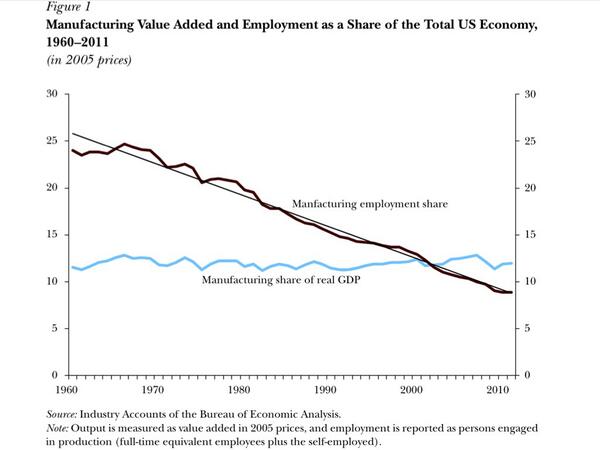

One graph says more than 1000 words of policies

USA and EU are talking about reindustrialisation efforts which not only aims to support and grow the share of industry in their economy, but also the (re)-creation of jobs within industry. With claims like: "Every new job in industry creates five new jobs in related services" these efforts are already contradictory: by creating new jobs in industry, the effect is that the share of employment in industry if falling even more because five more new service jobs will be created. Furthermore, since it is unlikely that each new industry job has a productivity of more than five times a service job, also in terms of share of GDP the industry is losing. So by growing and supporting industry, their share will become smaller.

One graph that explains the true and irreversible trends of the share of industry over time. It does not mean that industry if becoming irrelevant: we will still need goods in the future the same as we need to eat and drink from agriculture. It just means that the growing share of the service economy is irreversible. This is due to the success of industry: by ever increasing productivity there are less people needed to produce more and more goods for a decreasing price. Just as agriculture has become a small part of economy, because it is so successful: less people are employed in agricultural sector to feed a nation and less percentage of income in rich countries is spend on food. The same will be the case for manufacturing: less people will be employed and a smaller share of income will be spend on actual goods.

Here the graph:

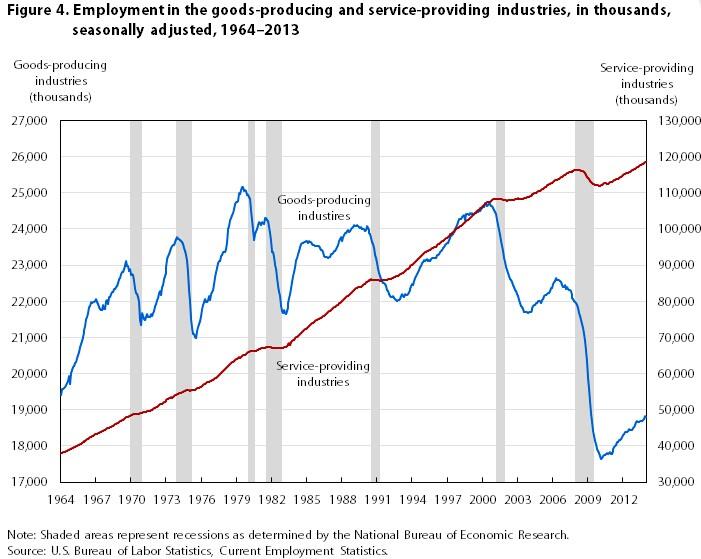

UPDATE 2nd Graph for USA:

One graph that explains the true and irreversible trends of the share of industry over time. It does not mean that industry if becoming irrelevant: we will still need goods in the future the same as we need to eat and drink from agriculture. It just means that the growing share of the service economy is irreversible. This is due to the success of industry: by ever increasing productivity there are less people needed to produce more and more goods for a decreasing price. Just as agriculture has become a small part of economy, because it is so successful: less people are employed in agricultural sector to feed a nation and less percentage of income in rich countries is spend on food. The same will be the case for manufacturing: less people will be employed and a smaller share of income will be spend on actual goods.

Here the graph:

UPDATE 2nd Graph for USA:

A Broken Place: The Spectacular Failure Of The Startup That Was Going To Change The World

"With almost $1 billion in funding and ambitions to replace

petroleum-based cars with a network of cheap electrics, Shai Agassi’s

Better Place was remarkable even by the standards of world-changing

startups. So was its epic failure. A 21st-century cautionary tale." A very interesting analysis about great vision, with great PR, but quite horrible execution and the opposite of the current Lean Startup ideas. Also very interesting to compare to the Tesla model with a similar vision for the far future, but a very clear and realistic Roadmap for how to get there. Read the article here

Subscribe to:

Comments (Atom)