Tuesday 22 April 2014

When technology spreads slowly

"One of the most important issues in thinking about the economic growth potential for the U.S. economy is this question: Has the U.S. economy already seen most of the economic growth that will result from the innovations in information and communication technology, including the web, the cloud, robotics, and so on? Or is the U.S. economy perhaps only a fraction of the way--perhaps even less than halfway--through its adaptation to the potential for productivity gains from these technologies, and thus has stronger prospects for future growth?"

Read the remaining here

Wednesday 16 April 2014

All innovation is good, unless it is bad

Innovation has a very positive meaning, while when is comes to financial innovation the connotation nowadays is very negative. For the financial innovations this is not without a reason, since it seems that the financial innovations were not designed to create more value for the customer, but actually create perceived new added value that turned out to be high risk products against which the creators of the financial innovations were betting. Winning by betting against the products you were selling. Now the current hot topic in financial innovations are High-Frequency Trading. The maing question is what function do they serve to the financial markets and the economy in general. Obviously they HFT emerged because of the incentive of each trader to be faster than their competitor. But the main question is if this also has benefits to the market and the economy in general. Stiglitz enters the debate:

"The U.S. banking sector has become less efficient in recent decades despite the increased use of new technologies like high-frequency trading and products such as derivatives, according to two papers presented at a Federal Reserve Bank of Atlanta conference." Read the rest of the article here

"The U.S. banking sector has become less efficient in recent decades despite the increased use of new technologies like high-frequency trading and products such as derivatives, according to two papers presented at a Federal Reserve Bank of Atlanta conference." Read the rest of the article here

Wednesday 9 April 2014

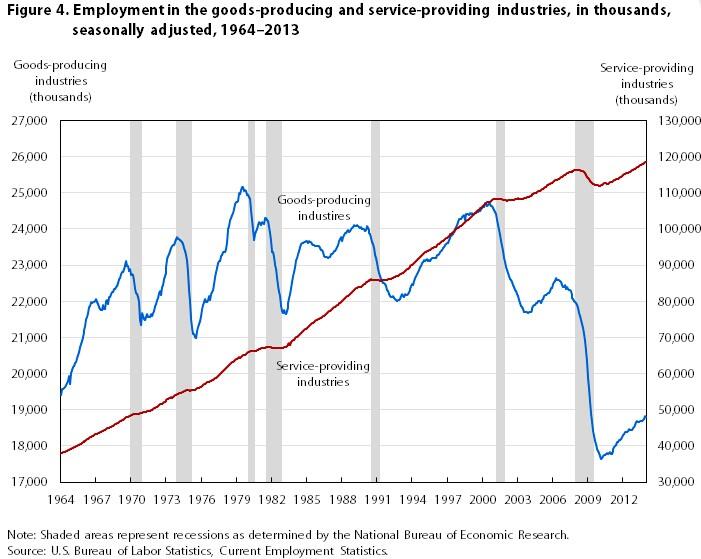

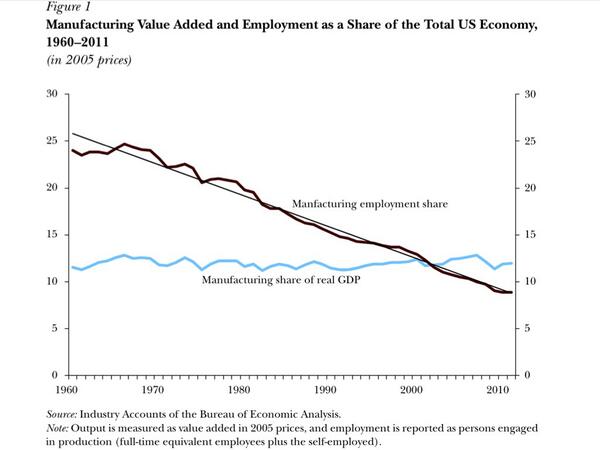

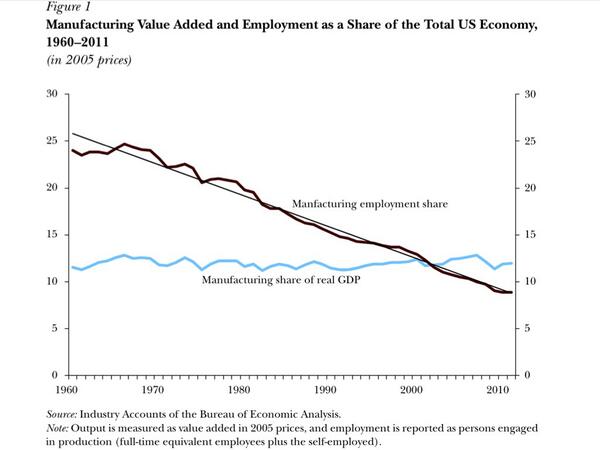

One graph says more than 1000 words of policies

USA and EU are talking about reindustrialisation efforts which not only aims to support and grow the share of industry in their economy, but also the (re)-creation of jobs within industry. With claims like: "Every new job in industry creates five new jobs in related services" these efforts are already contradictory: by creating new jobs in industry, the effect is that the share of employment in industry if falling even more because five more new service jobs will be created. Furthermore, since it is unlikely that each new industry job has a productivity of more than five times a service job, also in terms of share of GDP the industry is losing. So by growing and supporting industry, their share will become smaller.

One graph that explains the true and irreversible trends of the share of industry over time. It does not mean that industry if becoming irrelevant: we will still need goods in the future the same as we need to eat and drink from agriculture. It just means that the growing share of the service economy is irreversible. This is due to the success of industry: by ever increasing productivity there are less people needed to produce more and more goods for a decreasing price. Just as agriculture has become a small part of economy, because it is so successful: less people are employed in agricultural sector to feed a nation and less percentage of income in rich countries is spend on food. The same will be the case for manufacturing: less people will be employed and a smaller share of income will be spend on actual goods.

Here the graph:

UPDATE 2nd Graph for USA:

One graph that explains the true and irreversible trends of the share of industry over time. It does not mean that industry if becoming irrelevant: we will still need goods in the future the same as we need to eat and drink from agriculture. It just means that the growing share of the service economy is irreversible. This is due to the success of industry: by ever increasing productivity there are less people needed to produce more and more goods for a decreasing price. Just as agriculture has become a small part of economy, because it is so successful: less people are employed in agricultural sector to feed a nation and less percentage of income in rich countries is spend on food. The same will be the case for manufacturing: less people will be employed and a smaller share of income will be spend on actual goods.

Here the graph:

UPDATE 2nd Graph for USA:

A Broken Place: The Spectacular Failure Of The Startup That Was Going To Change The World

"With almost $1 billion in funding and ambitions to replace

petroleum-based cars with a network of cheap electrics, Shai Agassi’s

Better Place was remarkable even by the standards of world-changing

startups. So was its epic failure. A 21st-century cautionary tale." A very interesting analysis about great vision, with great PR, but quite horrible execution and the opposite of the current Lean Startup ideas. Also very interesting to compare to the Tesla model with a similar vision for the far future, but a very clear and realistic Roadmap for how to get there. Read the article here

Wednesday 2 April 2014

The Economist on patents and patent trolls

In an article of the Economist, the use of patents is discussed, particularly in business methods or software. Besides a good analysis of the current (US) situation regarding the practice of patent trolls and the legal issues related to broad patents claims, the article also discusses the role of patents as a metric of innovation:

"...patent issuance is a poor measure of innovation. Patenting is strictly a metric of invention. Innovation is such a vastly different endeavour—in terms of investment, time and the human resources required—as to be virtually unrelated to invention."

I whish more people recognizes this is the case. Unfortunately it is still common practice to include patents as a metric of innovation, often with the justification that we don't have any better. Since it is very unclear whether patents are positively, negatively or not correlated to innovation it would be equally justified to include any other random indicator as a metric of innovation. For example the share of population being left-handed with blue eyes and dark hair.

Read the whole article of The Economist here

Image: Jac Depczyk

"...patent issuance is a poor measure of innovation. Patenting is strictly a metric of invention. Innovation is such a vastly different endeavour—in terms of investment, time and the human resources required—as to be virtually unrelated to invention."

I whish more people recognizes this is the case. Unfortunately it is still common practice to include patents as a metric of innovation, often with the justification that we don't have any better. Since it is very unclear whether patents are positively, negatively or not correlated to innovation it would be equally justified to include any other random indicator as a metric of innovation. For example the share of population being left-handed with blue eyes and dark hair.

Read the whole article of The Economist here

Image: Jac Depczyk

Stiglitz on innovation

It is quite rare that an economist understands innovation. Schumpeter was an exception, but it seems there is once again an economist who contributes to our understanding of innovation. Nobody less than Joseph E. Stiglitz wrote about the added value of innovation. It is to believed that innovation is a goal in it self, but why? What is the added value of innovation to our life, our income, to productivity? Stiglitz researches the added value of innovation to our life, well being and income:

It is quite rare that an economist understands innovation. Schumpeter was an exception, but it seems there is once again an economist who contributes to our understanding of innovation. Nobody less than Joseph E. Stiglitz wrote about the added value of innovation. It is to believed that innovation is a goal in it self, but why? What is the added value of innovation to our life, our income, to productivity? Stiglitz researches the added value of innovation to our life, well being and income:"NEW YORK – Around the world, there is enormous enthusiasm for the type of technological innovation symbolized by Silicon Valley. In this view, America’s ingenuity represents its true comparative advantage, which others strive to imitate. But there is a puzzle: it is difficult to detect the benefits of this innovation in GDP statistics.

What

is happening today is analogous to developments a few decades ago,

early in the era of personal computers. In 1987, economist Robert Solow –

awarded the Nobel Prize for his pioneering work on growth – lamented

that “You can see the computer age everywhere but in the productivity

statistics.” There are several possible explanations for this.

Perhaps

GDP does not really capture the improvements in living standards that

computer-age innovation is engendering. Or perhaps this innovation is

less significant than its enthusiasts believe. As it turns out, there is

some truth in both perspectives."

Read more here"

Thursday 20 February 2014

Wednesday 29 January 2014

Can America Afford Innovation?

In USA the discussion on the disappearance of the middle class is ongoing, but also in Europe and other developed nations many people looking forward to the impact of new technologies warn about this possible trend of disappearance of middle-income jobs. In an article in Slate, Matthew Yglesias analysis the feed-back that would have to innovation. How can you continue to innovate if there are only low-paid and very high paid jobs? Who will do the research/development/innovation?

Read the article here

Tuesday 28 January 2014

How to be Silicon Valley?

An old blog-post, but still relevant.

Angel investor Paul Graham wrote 7 years ago about what to do to become like Silicon Valley. He summarizes you need rich people and nerds. And to have nerds, you need a strong university system, urban density and a cool factor through a strong cultural life (resembles Richard Florida's 3Ts somehow). His full length blog can be found here

Some more interesting quotes from the blog:

"Bureaucrats by their nature are the exact opposite sort of people from startup investors. The idea of them making startup investments is comic. It would be like mathematicians running Vogue-- or perhaps more accurately, Vogue editors running a math journal."

"An article about Sophia Antipolis bragged that companies there included Cisco, Compaq, IBM, NCR, and Nortel. Don't the French realize these aren't startups?"

"If you go to see Silicon Valley, what you'll see are buildings. But it's the people that make it Silicon Valley, not the buildings. I read occasionally about attempts to set up "technology parks" in other places, as if the active ingredient of Silicon Valley were the office space."

Subscribe to:

Posts (Atom)